How to Calculate Zakat in Islam: A Simple Walkthrough

Money feels light when it flows. Heavy when it just sits. That is where Zakat steps in.

Zakat is not just another payment. It is one of the Five Pillars of Islam. A duty. A purifier. A bridge between your wealth and someone else’s needs.

But here is the big question. How do you calculate it?

Let’s break it down. Step by step.

What Is Zakat?

Zakat is an annual payment on wealth. If your savings or assets reach the minimum set point, called Nisab, you give 2.5 percent of it.

That 2.5 percent is not random. It is a divine measure. Just enough to keep your wealth clean. Just enough to support the poor, the needy, plus others mentioned in the Quran.

Think of it like wiping dust off a mirror. Small effort. Big clarity.

Easily calculate your Zakat with our Riyadh Khaleej Zakat Calculator today – quick, accurate, and hassle-free

The Idea Behind It

Zakat is not charity. It is a right. A right of the community on your wealth.

It teaches balance. You keep the bulk. You share a slice.

I remember my father saying, “Zakat does not reduce your money. It multiplies your blessings.” I understood it years later when I gave my first Zakat as a student with small savings.

Step One: Check the Nisab

First, ask yourself: have you crossed the Nisab?

The Nisab is the minimum wealth that makes Zakat compulsory. It is linked to the value of 85 grams of gold or 595 grams of silver.

Why two measures? Because historically, both were used. Today, many scholars suggest using the silver standard because it benefits more poor people.

So, check the current price of gold and silver in your country. Multiply by the weight. That gives you the Nisab value.

If your savings and assets are equal to or above that number, you owe Zakat. If not, you are free for that year.

Step Two: Know What Counts

Zakat does not cover everything you own. It applies to certain types of wealth. Here is the list:

- Cash in hand or bank accounts

- Gold and silver, including jewelry

- Business goods you intend to sell

- Investments like stocks or shares (at market value)

- Rental income if saved

- Money owed to you that you expect to get back

On the flip side, items like your house, car, daily clothes, or personal furniture do not count. Zakat is only on wealth that grows or stays beyond your daily needs.

Step Three: Subtract Debts

Before calculating, subtract what you owe.

If you have short-term debts—like unpaid bills, rent due, or loans you must pay soon—you deduct them. What remains after debts is your Zakatable wealth.

So, it is not just about what you have. It is about what you truly own free and clear.

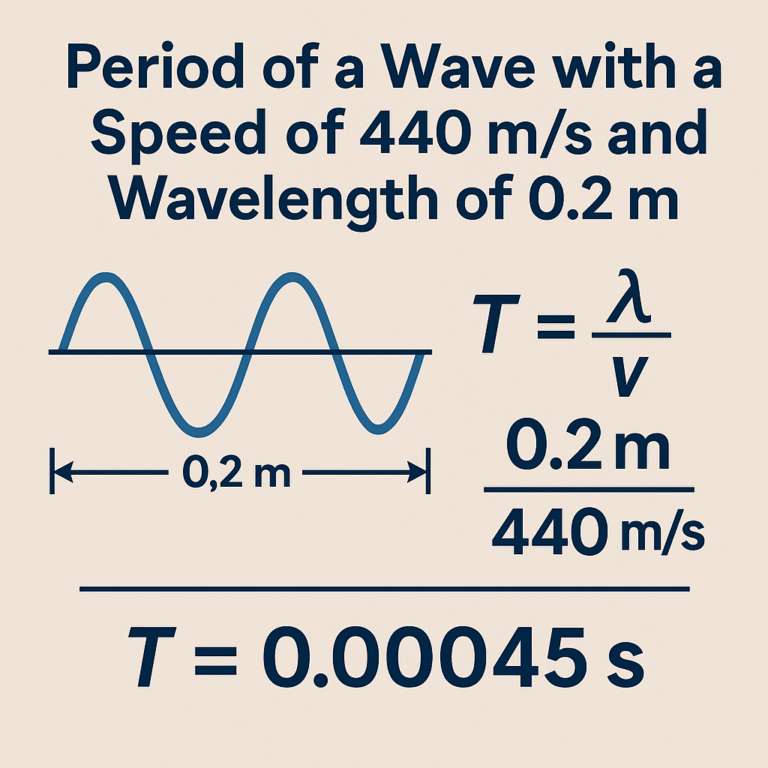

Step Four: Do the Math

Here comes the simple formula.

- Add up all your Zakatable assets.

- Subtract immediate debts.

- If the total is above the Nisab, multiply by 2.5 percent.

That final number is your Zakat.

An Example

Let’s say you have:

- Savings: $5,000

- Gold worth: $3,000

- Business stock: $2,000

Total = $10,000

Now, your debts for the year are $2,000. Subtract that. You are left with $8,000.

Current Nisab (using silver) is about $500. Your $8,000 is well above that.

So, you calculate 2.5 percent.

$8,000 × 0.025 = $200

That is your Zakat. Simple math.

When Do You Pay?

Zakat is due once a full lunar year passes since you reached the Nisab. This is called Hawl.

Many people choose Ramadan to pay. It feels spiritual plus it is easier to track. But technically, your due date depends on when you first crossed the Nisab.

So, if you reached it in Muharram, your Zakat is due every Muharram.

Can You Pay Early?

Yes, you can. If you expect income later or want to align with Ramadan, you can pay early.

Some people even give in installments—monthly or quarterly—to make it lighter. As long as the full amount is covered, it counts.

Zakat on Different Assets

Gold and Silver

If your gold or silver crosses the Nisab, you owe Zakat on it. You calculate either by weight or by market value.

Business Goods

For traders, the value of stock at year-end counts. Only goods meant for sale, not shelves or equipment.

Investments

Stocks are valued at their market price. Dividends saved also count.

Property

Your personal home does not count. But if you buy land to sell later, or you rent property and save the income, that is Zakatable.

Who Can Receive Zakat?

The Quran lists eight categories. They include:

- The poor

- The needy

- People in debt

- Travelers in hardship

- Those working to collect and distribute Zakat

In practice, you can give through your mosque, trusted charities, or directly to families in need.

But remember—Zakat is not for wealthy relatives or personal gain. It is meant to lift real hardship.

A Quick Checklist

Here is a simple way to remember:

- Weigh your wealth.

- Check against Nisab.

- Deduct debts.

- Multiply by 2.5 percent.

- Distribute before your due date.

Common Questions

Do I pay Zakat on my salary?

Not directly. But if part of your salary remains saved for a year and crosses Nisab, yes.

What about retirement funds?

Zakat applies if you can access the money. If it is locked, wait until withdrawal.

Do children pay Zakat?

Yes, if they own wealth above Nisab. Parents usually calculate on their behalf.

What if I forget the exact date I hit Nisab?

Choose a fixed date, like Ramadan, and stick to it yearly.

The Spiritual Touch

Numbers matter. But Zakat is not just math. It is faith in action.

It breaks greed. It builds compassion. It turns wealth from something personal into something shared.

When you give, you do not lose. You grow.

I once gave Zakat online to a charity that bought Eid clothes for orphans. Days later, I saw the photos. Bright smiles. Small hands holding new shoes. My money had turned into joy. That feeling stayed with me longer than the cash ever would.

Wrapping Up

Calculating Zakat is not complicated. Add, subtract, check Nisab, then give 2.5 percent. That is it.

Zakat purifies your wealth plus uplifts others. It is both math and mercy.

So, next time you glance at your bank balance or jewelry box, pause. Run the numbers. Set aside your share.

Let your wealth shine not just for you, but for someone else too.

Because blessings grow when shared.