Zakat Calculator: A Simple Guide to Giving with Clarity

You know that moment when giving feels good but the math feels messy?

That is where a Zakat calculator steps in.

Zakat is not just a number. It is one of the Five Pillars of Islam. A way to purify your wealth plus share blessings with those who need them. But figuring it out on your own can feel like solving a puzzle with missing pieces.

So let us break it down. Step by step. Clear. Simple. Friendly.

What Is Zakat?

Zakat means “to purify” in Arabic. Think of it as cleansing your money. A little like trimming a plant so it grows better.

Every Muslim who meets the requirements must give Zakat. It is usually 2.5 percent of your wealth. That includes savings, gold, silver, investments, and sometimes business assets.

It is not a tax. It is not charity in the casual sense. It is an act of worship.

I remember my father sitting with his old calculator every Ramadan. Piles of receipts on the table. Scribbles on scrap paper. He wanted to make sure not a single cent was missed. That memory sticks with me whenever I talk about Zakat today.

Give with clarity and peace of mind. Try the Khaleej Zakat Calculator today.

Why a Calculator Helps

Let us be real. Doing the math by hand is not easy.

Gold prices change. Bank balances shift. Assets get complicated.

A Zakat calculator takes the guesswork out. You plug in your numbers, and it works out what you owe. No stress. No confusion. Just clarity.

Think of it like a recipe app. You add the ingredients you have, and it tells you the exact dish you can cook.

Who Needs to Pay Zakat?

Not everyone is required to pay. There are clear rules.

- You must be an adult Muslim.

- Your wealth must reach or exceed the Nisab (the minimum threshold).

- One lunar year should pass over that wealth.

The Nisab can be calculated in gold or silver. For example, if you use gold, the Nisab is the value of 87.48 grams of gold. If you use silver, it is 612.36 grams.

Most people today check the current price of gold or silver to decide. The calculator usually does this for you.

What Counts as Zakatable Wealth?

Here is a quick list to guide you:

- Cash in hand or bank accounts – including savings.

- Gold and silver – jewelry too, depending on your school of thought.

- Investments – like stocks, shares, or crypto.

- Business assets – inventory meant for sale.

- Rental income – if it is savings.

On the flip side, your personal home, car, clothes, and daily essentials are not counted.

It is like sorting your closet. Some items are part of your everyday wear, while others are for special occasions. Zakat only applies to certain “special” assets.

How to Use a Zakat Calculator

Here is the easy part.

- Enter your cash savings. Add all accounts plus cash at home.

- Include gold and silver. The calculator will use today’s market value.

- Add investments. Think shares, funds, crypto.

- Include business goods. Only what you intend to sell.

- Deduct debts. If you owe money, subtract it.

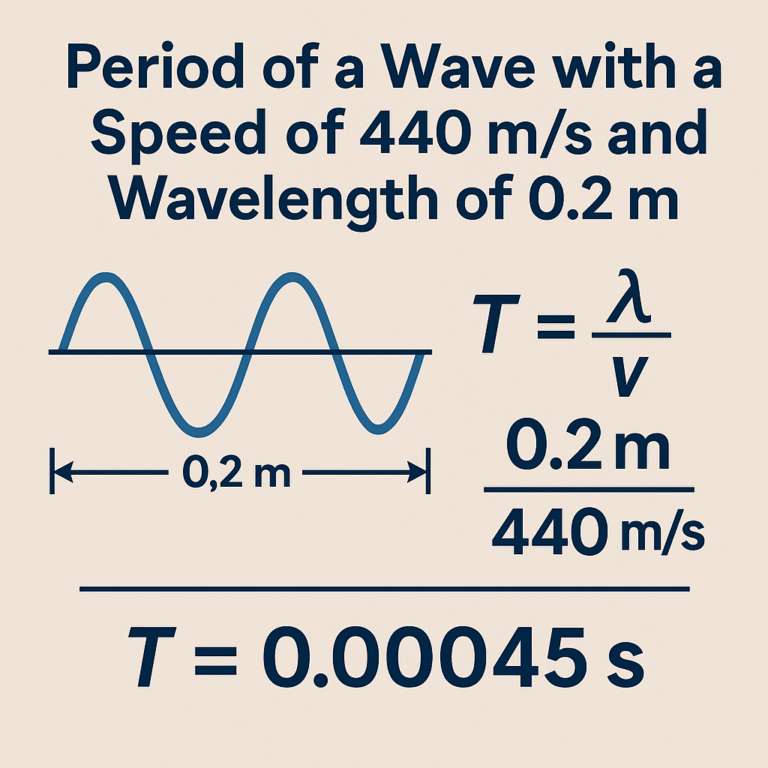

Then the calculator applies the 2.5 percent rule. That is your Zakat.

So if you have $10,000 saved, your Zakat is $250. Simple.

The Role of Nisab

Nisab is like the entry ticket. If your wealth does not reach it, you do not pay Zakat.

Many calculators now include updated Nisab values based on gold and silver prices. That way, you do not need to hunt for the numbers.

Think of it as the minimum bar in a high jump. If you cannot reach it, you do not compete.

Benefits Beyond Numbers

Zakat is more than math. It connects you with your community. It builds empathy.

Imagine a family receiving groceries for the month because of your Zakat. Or a student paying tuition fees. That ripple effect goes further than you can see.

The calculator is just the tool. The impact is the real story.

Online Zakat Calculators

You do not need to be a math whiz.

Most Islamic banks, charities, and even apps now offer free calculators.

You simply type your numbers. Click. Done.

I tried one last Ramadan. It took less than three minutes. Faster than making tea.

Common Mistakes People Make

Even with calculators, some slip-ups happen. Let us clear them up:

- Forgetting to include jewelry.

- Not deducting debts.

- Mixing up gross income with savings.

- Skipping business inventory.

A calculator reminds you to tick every box.

When to Pay Zakat

Most people give during Ramadan. The reward feels doubled.

But technically, you can pay once your lunar year ends. The key is to stay consistent.

Some people set a reminder on their phone. Others mark it on a calendar. Small habits, big impact.

Where to Pay Zakat

Zakat goes to specific groups. The Qur’an outlines them clearly.

- The poor.

- The needy.

- Those in debt.

- Travelers in difficulty.

- And a few other categories.

Today, charities often help distribute it for you. You can give locally or internationally.

Why Simplicity Matters

Life is already busy. Between work, family, and bills, calculating Zakat should not feel like climbing a mountain.

That is why a Zakat calculator feels like a blessing. It simplifies without taking away meaning.

So instead of getting stuck on the “how,” you can focus on the “why.”

A Personal Note

I once delayed paying Zakat because I felt unsure about the math. Weeks passed. Guilt piled up.

When I finally used a calculator, it clicked. Fast. Clear. Done. I wished I had not waited so long.

Tips for a Smooth Process

- Keep financial records handy.

- Update gold and silver prices regularly.

- Check debts before finalizing.

- Use a trusted calculator from a known source.

It is like cooking with fresh ingredients. The quality of what you put in decides the result.

Final Thoughts

Zakat is not just an obligation. It is a chance. A chance to give. A chance to grow.

The Zakat calculator is your helping hand. It takes the pressure off so you can focus on intention.

So next time Ramadan comes—or whenever your Zakat date is—try one. Open it. Add your numbers. Press calculate.

You will feel lighter. Not just financially, but spiritually.